A recent welcome rainstorm in Australia provided firefighters a brief respite in their months-long battle against raging wildfires. Amid record high temperatures and one of the worst droughts in memory, the fires have burned 18 million acres, affected more than half a billion animals, killed millions of those animals and at least 28 people, destroyed 3,000 homes in New South Wales alone, worsened air quality in Sydney to 11 times the hazardous level, and disrupted millions of human lives.

A convergence of news this week feels a bit like that rainstorm, providing some hope even though it will be a long time until climate change action matches up to the challenge. Announcements from major corporations attest to a growing recognition that climate risk and investment risk are one and the same — and by not dealing with climate risk, companies are increasing the odds that their business will be disrupted by problems to which they are adding.

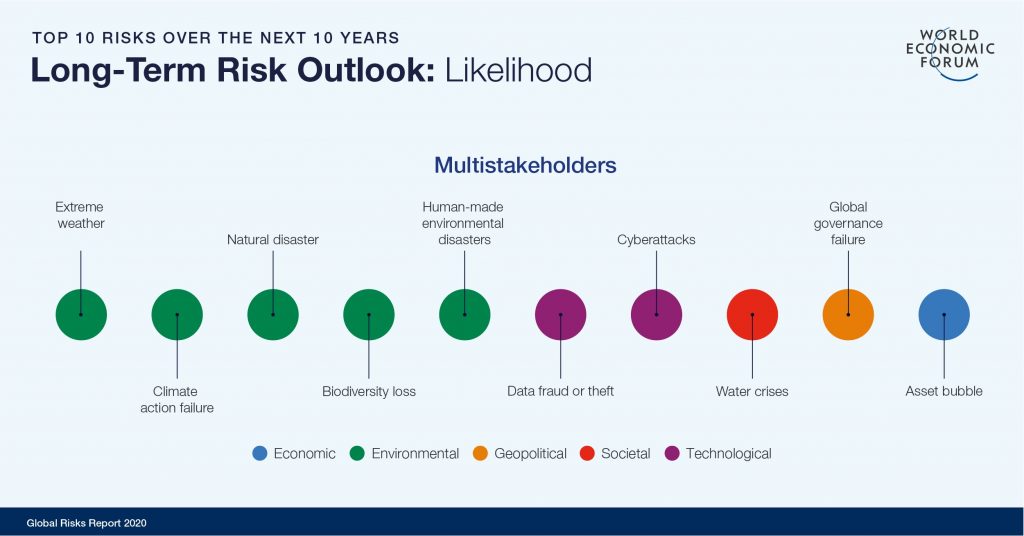

For the first time, all five top risks in the World Economic Forum’s 2020 Global Risks Report are climate change related: extreme weather, failure of climate change action, natural disasters, biodiversity loss, and human-caused natural disasters. The World Economic Forum itself is offsetting the greenhouse gas emissions of the business, government, and civil society actors converging on Davos, Switzerland, for their annual meeting. (Yes, many of them will travel by private plane, as the media reports every year as if they were discovering for the first time the irony of business leaders talking about the need to deal with climate change but not adjusting their mode of travel.)

Here in Chicago, the city council is preparing to declare a climate emergency: “Restoring a safe and stable climate requires a Climate Mobilization, an emergency mobilization on a scale not seen since World War II in order to reach zero greenhouse gas emissions across all sectors of the economy; to rapidly and safely drawdown and remove all the excess carbon from the atmosphere at emergency speed and until safe, pre-industrial climate conditions are restored; and to implement measures to protect all people and species from the consequences of abrupt climate breakdown …”

In other positive news, Microsoft pledged that its activities would be carbon negative by 2030 –that is, removing more carbon from the atmosphere than it emitted– and that it would offset completely the impact of its historical carbon emissions by 2050.

In this context, BlackRock CEO Larry Fink’s annual letter to CEOs was especially timely, arguing that climate change will fundamentally re-shape finance. He pointed out the many specific questions that climate change raises:

“Will cities, for example, be able to afford their infrastructure needs as climate risk reshapes the market for municipal bonds? What will happen to the 30-year mortgage – a key building block of finance – if lenders can’t estimate the impact of climate risk over such a long timeline, and if there is no viable market for flood or fire insurance in impacted areas? What happens to inflation, and in turn interest rates, if the cost of food climbs from drought and flooding? How can we model economic growth if emerging markets see their productivity decline due to extreme heat and other climate impacts?”

Fink continued:

“These questions are driving a profound reassessment of risk and asset values. And because capital markets pull future risk forward, we will see changes in capital allocation more quickly than we see changes to the climate itself. In the near future – and sooner than most anticipate – there will be a significant reallocation of capital.”

In response, BlackRock announced that it will make sustainability integral to portfolio construction and risk management; exite investments that present a high sustainability-related risk, such as thermal coal producers; launch new investment products that screen fossil fuels; and strengthen its commitment to sustainability and transparency in our investment stewardship activities.

Fink’s letter echoed much of the language of last year’s Business Roundtable update of its statement of corporate purpose to incorporate all stakeholders –not just shareholders. A challenge to decades of putting “shareholder primacy” above all, that statement was a watershed in recognizing that businesses need to come to terms with: they reap what they sow when it comes to activities that create risks for others.

Ignoring the consequences of their actions ultimately does not help businesses. If companies contribute to global risks, they make themselves more vulnerable to them.

Recognition –and acceptance– of the risks related to climate change is essential. Despite some vocal deniers, the critical mass is with people who see an obvious danger and believe it is urgent to deal with it.

Are we a climate change tipping point in terms of awareness and action? I asked this question in Spring 2019, as student climate strikes were heating up and central banks and investors were issuing warnings about the potential impact of climate change on the global financial system.

This week it’s worth asking again. The rising concerns and actions of corporations and CEOs are an encouraging step. We’re further ahead than we were at this time last year, but, like Australia’s embattled firefighters, we have a long way to go.

This article is part of my new LinkedIn newsletter series, “Around My Mind” – a regular walk through the ideas, events, people, and places that kick my synapses into action, sparking sometimes surprising or counter-intuitive connections.

To subscribe to “Around My Mind” and get notifications of new posts, click the blue button on the top right hand on this page. Please don’t be shy about sharing, leaving comments or dropping me a private note with your own reactions.

- Gray Rhino Risks and Responses to Watch in 2024 - January 10, 2024

- Chapter Zero Italy: Assessing Long-term Climate Impact Scenarios - August 8, 2023

- Banking Crisis Part II: Some Obvious Lessons that Bear Repeating - March 24, 2023